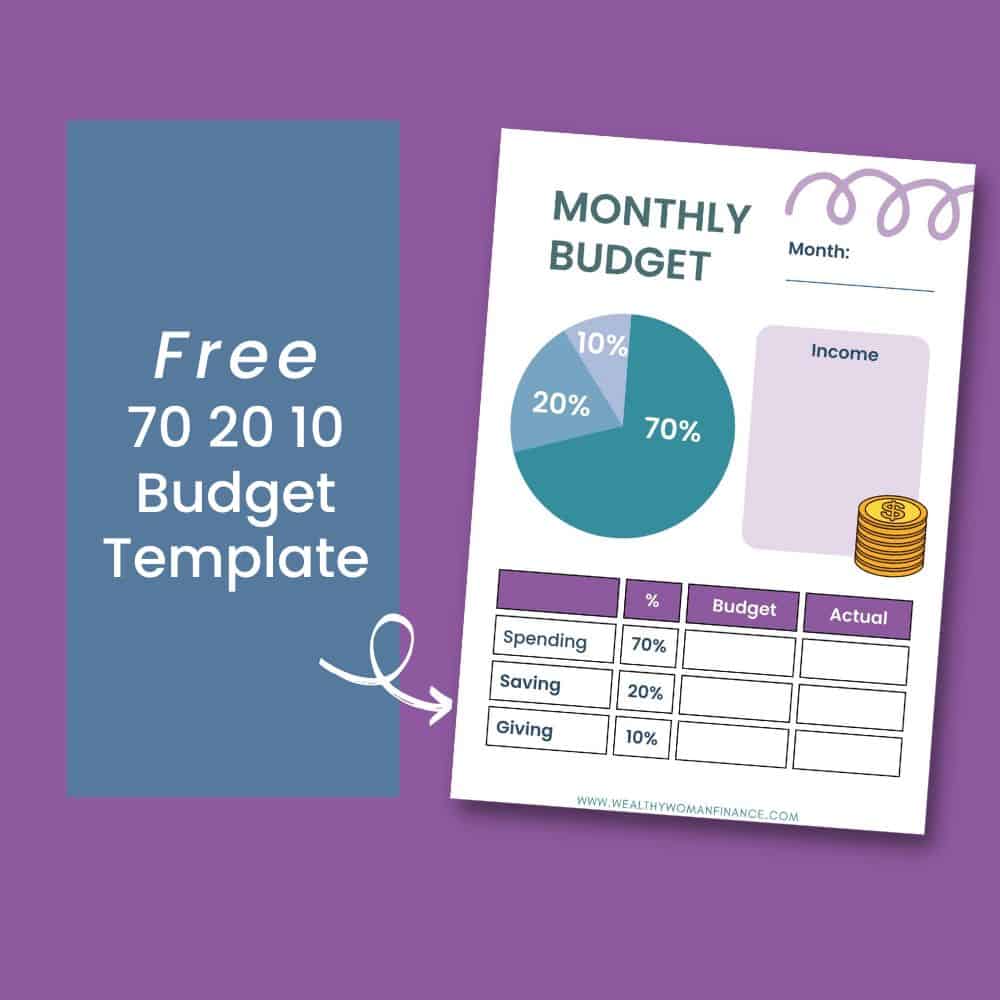

70/20/10 Budget Template

70/20/10 Budget Template - This rule refers to dividing your income into three categories. Ad no matter your mission, get the right financial software to accomplish it. Ad easily manage employee expenses. Save time on expense reports with everything in one place & approve with just one click. Who would’ve thought a study from the 1980s would inspire one of the most popular l&d models we know today? Do these steps for the wants and. Rather than managing your gross income down to the last penny, this simple budget method is just a general guideline that can help you set realistic financial goals. Web the 70:20:10 rule is one budgeting method that has gained popularity in recent times due to its simplicity. 50% of net pay for needs, 30% for wants and 20% for. Ad manage all your business expenses in one place with quickbooks®.

70 20 10 Rule Budget (What is It & How Does it Work?)

This rule refers to dividing your income into three categories. Get powerful, streamlined insights into your company’s finances. You'll use your net monthly income as the baseline for how to budget each month. Do these steps for the wants and. Rather than managing your gross income down to the last penny, this simple budget method is just a general guideline.

70 20 10 Budget Planner Budget Printable Template monthly Etsy UK

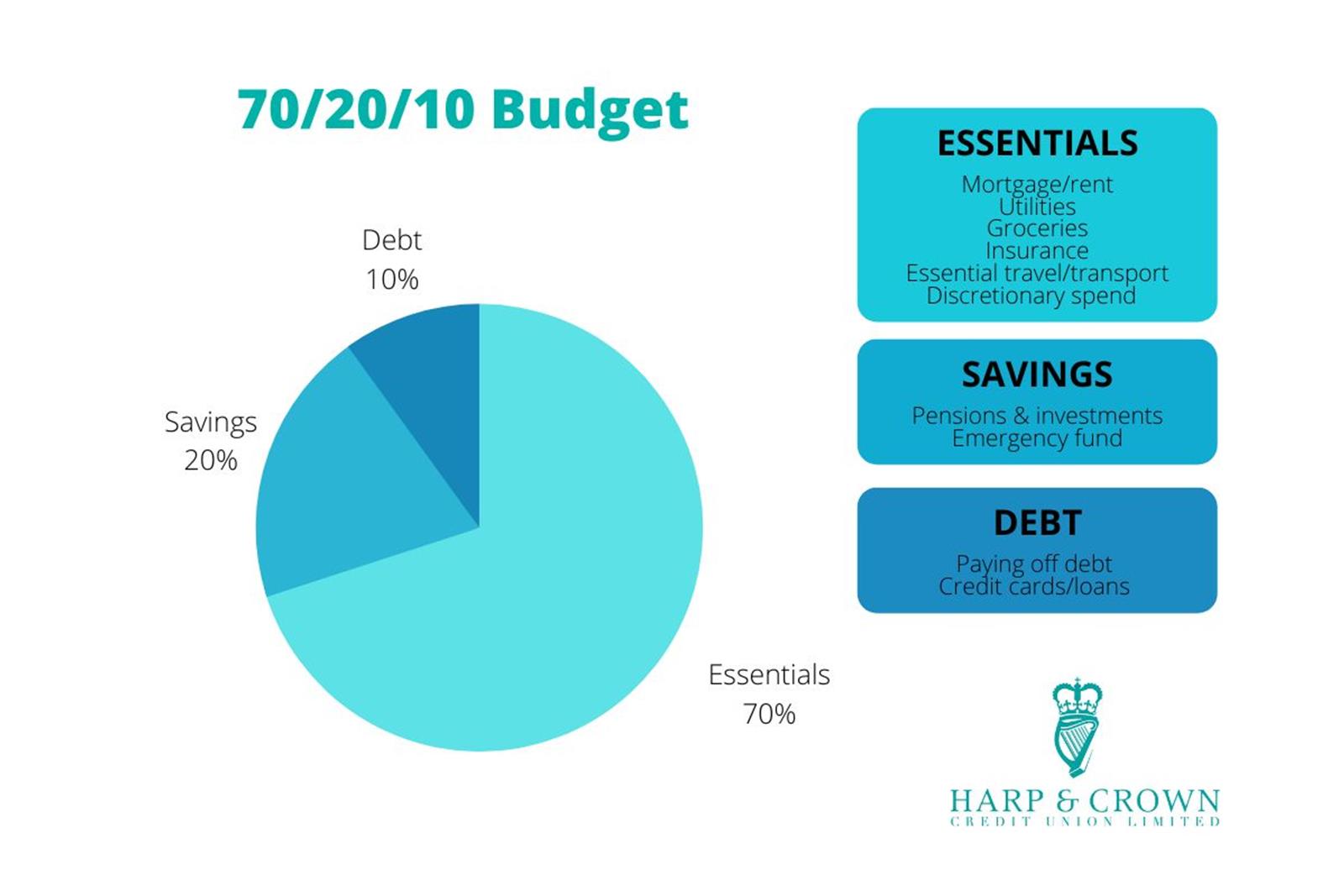

The 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go. Ad easily manage employee expenses. Web in the 70/20/10 budget system, 70% of your income is allocated to needs and wants, 20% to savings and investments, and 10% to debt repayment. It’s a relatively simple way to budget your.

70 20 10 Budget Tracker Excel Spreadsheet Monthly Budget Etsy

It’s a relatively simple way to budget your money and manage finances. Free for 30 days and easy to use. Web you can easily grab a piece of paper, divide it into three main sections, and build your budget right there. But sometimes, it can be nice to have something ready to. The 70/20/10 budget rule is a money management.

70 20 10 Budget 70 20 10 Budget Planner 70 20 10 Budget Etsy

This rule refers to dividing your income into three categories. Web the 70:20:10 rule is one budgeting method that has gained popularity in recent times due to its simplicity. Web what is the 70/20/10 budget rule? Web you can easily grab a piece of paper, divide it into three main sections, and build your budget right there. Free for 30.

70 20 10 Budget Planner Budget Printable Template monthly Etsy Israel

Ad accounting software for small business. How the 70:20:10 budget rule works. Ad no matter your mission, get the right financial software to accomplish it. This rule refers to dividing your income into three categories. Monthly bills (70%), savings (20%), and debt repayment.

70/20/10 Budget Planner 70 20 10 Template 70 20 10 Method Etsy

Free for 30 days and easy to use. Fully integrated w/ employees, invoicing, project & more. Web you can easily grab a piece of paper, divide it into three main sections, and build your budget right there. Ad easily manage employee expenses. Web use the free printable budget worksheet below to see how your spending compares with the 50/30/20 budget.

70 20 10 Budget Printable 70 20 10 Budget Planner Monthly Etsy Denmark

Free for 30 days and easy to use. The 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go. Do these steps for the wants and. Web use the free printable budget worksheet below to see how your spending compares with the 50/30/20 budget guide. How the 70:20:10 budget rule.

70 20 10 Budget Planner 70 20 10 Budget Printable Monthly Etsy

How the 70:20:10 budget rule works. The 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go. But sometimes, it can be nice to have something ready to. Web you can easily grab a piece of paper, divide it into three main sections, and build your budget right there. Fully.

Budgeting 70 20 10 rule Credit Union news Financial wellbeing

The 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go. Web you can easily grab a piece of paper, divide it into three main sections, and build your budget right there. This approach reflects both the. Web the 70:20:10 rule is one budgeting method that has gained popularity in.

70 20 10 Budget Planner Budget Printable Template monthly Etsy Israel

Web you can easily grab a piece of paper, divide it into three main sections, and build your budget right there. You'll use your net monthly income as the baseline for how to budget each month. Web the 70:20:10 rule is one budgeting method that has gained popularity in recent times due to its simplicity. Web in the 70/20/10 budget.

Monthly bills (70%), savings (20%), and debt repayment. The 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go. Web in the 70/20/10 budget system, 70% of your income is allocated to needs and wants, 20% to savings and investments, and 10% to debt repayment. How the 70:20:10 budget rule works. This rule refers to dividing your income into three categories. Ad manage all your business expenses in one place with quickbooks®. Web the 70:20:10 rule is one budgeting method that has gained popularity in recent times due to its simplicity. Web you can easily grab a piece of paper, divide it into three main sections, and build your budget right there. You'll use your net monthly income as the baseline for how to budget each month. Save time on expense reports with everything in one place & approve with just one click. But sometimes, it can be nice to have something ready to. It’s a relatively simple way to budget your money and manage finances. What is the 70/20/10 rule of money? Fully integrated w/ employees, invoicing, project & more. Web use the free printable budget worksheet below to see how your spending compares with the 50/30/20 budget guide. Do these steps for the wants and. This approach reflects both the. If this budget sheet isn’t right for you, try. Easily find the financial software you're looking for w/ our comparison grid. First calculate your monthly income.