Asc 842 Calculation Template

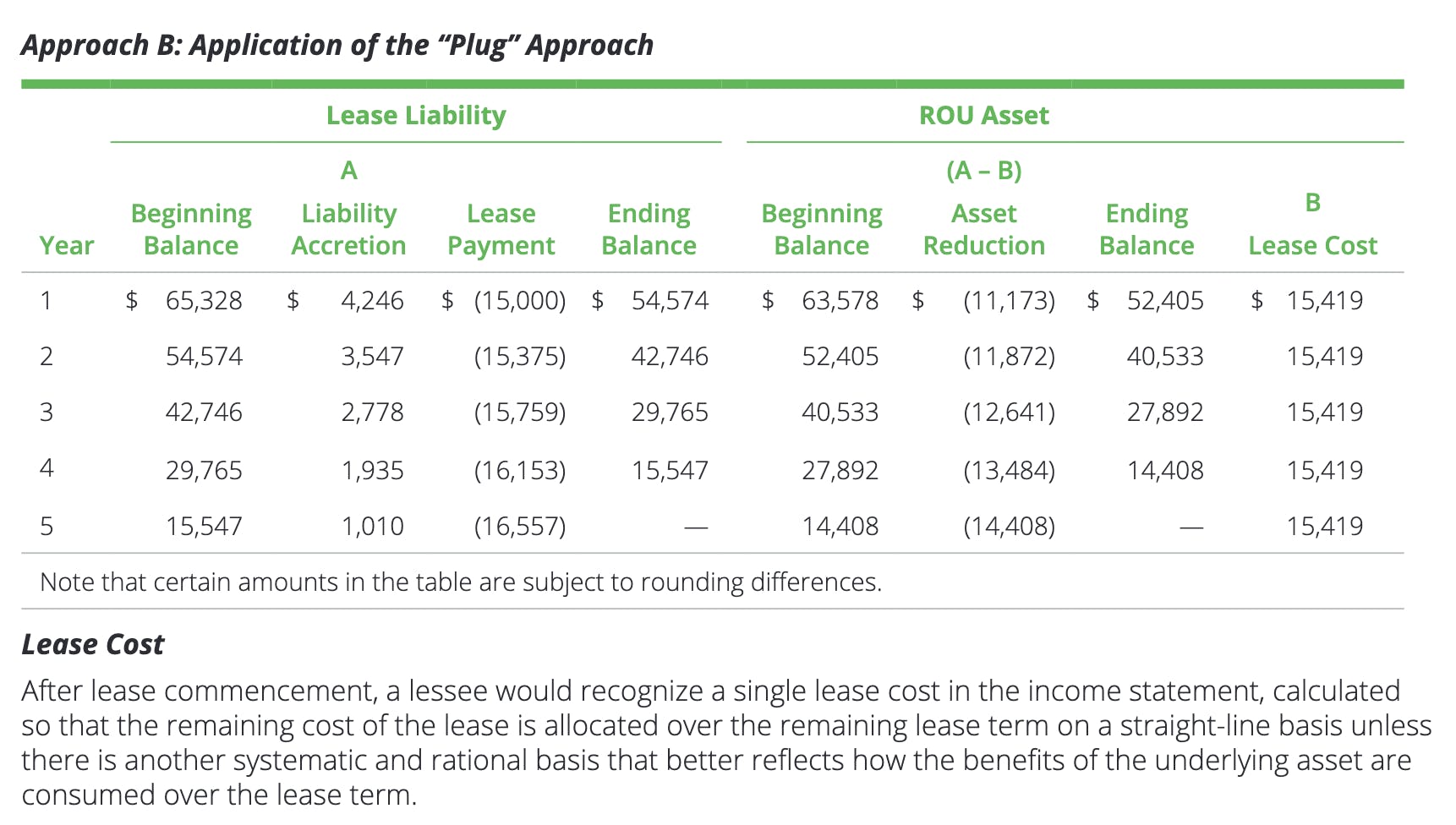

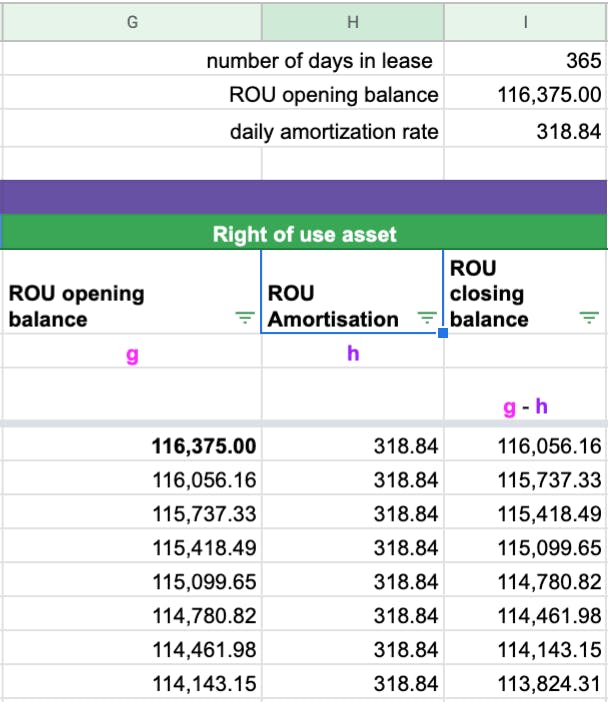

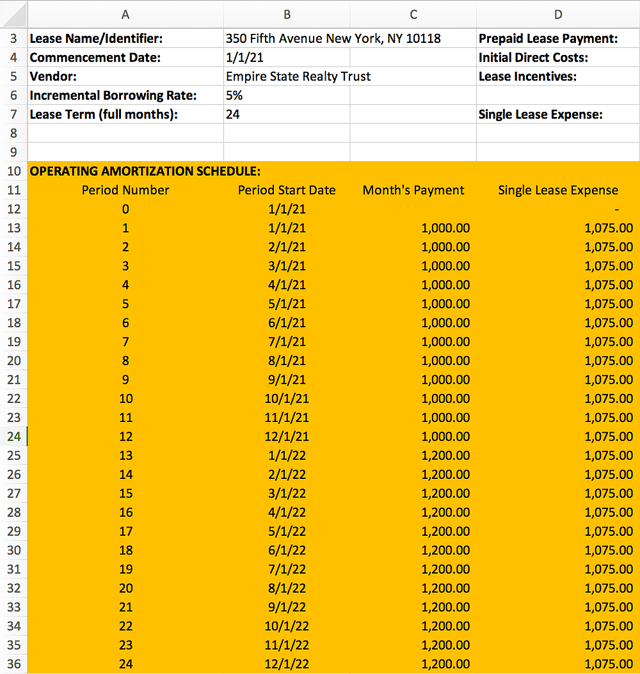

Asc 842 Calculation Template - Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. Determine the total lease payments under gaap step 3:. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Larson lease accounting template asc 842. Determine the lease term under asc 840 step 2: The term is the total amount of the time between the. January 1, 2021 lease end date: With our lease amortization schedule excel template, seamlessly. Web the rate component of the present value calculation is also called the discount rate, and your company has a few options to choose from as it applies asc 842. Web a lease liability is required to be calculated for both asc 842 & ifrs 16.

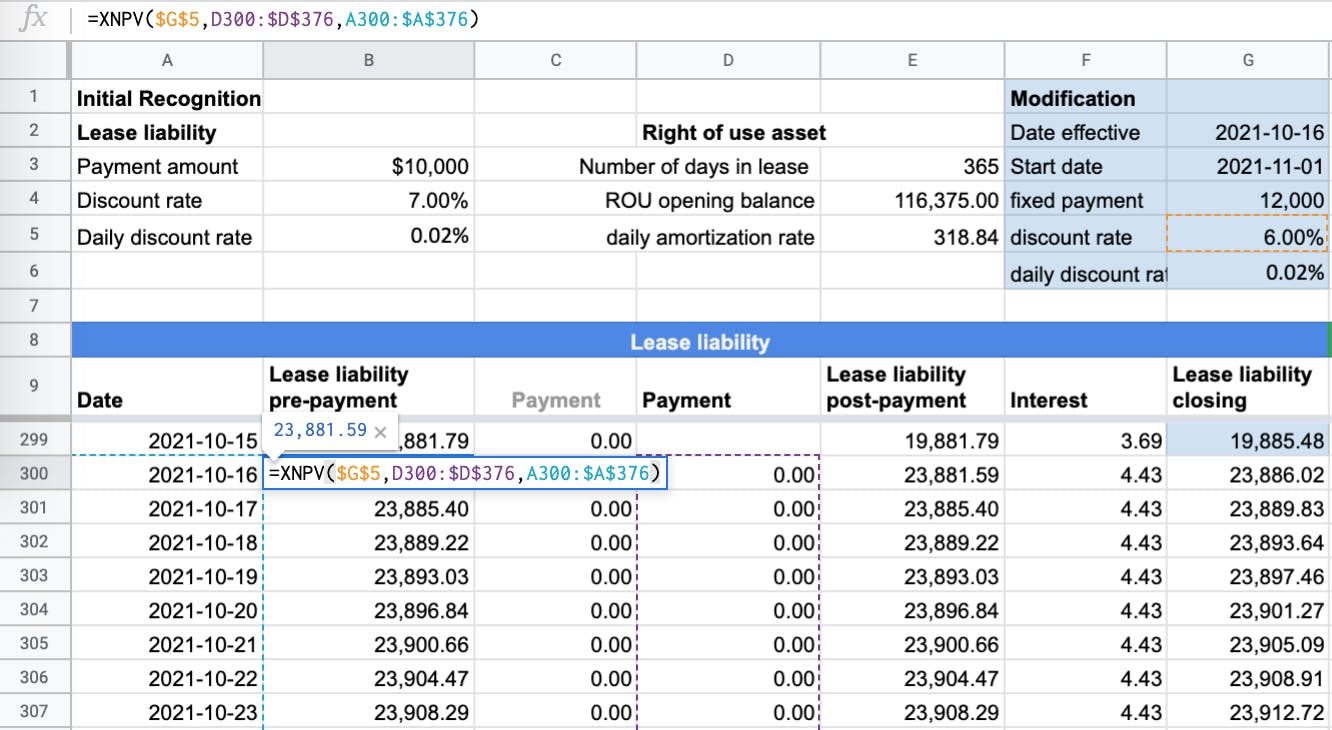

How to Reconcile Non GAAP Lease Accounting with ASC 842 for an

The term is the total amount of the time between the. Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. Web larson lease accounting template asc 842. Ad uslegalforms.com has been visited by 100k+ users in the past month This is calculated as the initial step in accounting for a lease under asc.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Asc 842 effective dates effective date for public companies effective date for private companies. Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. In turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: Web the rate component of the present value calculation is also.

ASC 842 Excel Template Download

For a comprehensive discussion of the. Larson lease accounting template asc 842. Web as noted above, the first step in calculating the lease liability, is to determine the term of the lease. In turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: January 1, 2021 lease end date:

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Web as noted above, the first step in calculating the lease liability, is to determine the term of the lease. Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. With our lease amortization schedule excel template, seamlessly. January 1, 2021 lease end date: Web asc 842 is a lease accounting standard by the.

How to Calculate a Finance Lease under ASC 842

Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Click the link to download a template for asc 842. Web learn more about lease accounting. Web download our free asc 842 lease accounting calculator and calculate the.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Web asc 842 is a lease accounting standard by the financial accounting standards board (fasb), requiring all leases longer than 12 months to be reflected on a. With our lease amortization schedule excel template, seamlessly. Ad embarkwithus.com has been visited by 10k+ users in the past month Web a lease liability is required to be calculated for both asc 842.

ASC 842 Guide

This is calculated as the initial step in accounting for a lease under asc 842,. Larson lease accounting template asc 842. Ad embarkwithus.com has been visited by 10k+ users in the past month Determine the lease term under asc 840 step 2: Embedded lease test use this free tool to determine if your contract contains a lease.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. With our lease amortization schedule excel template, seamlessly. Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. For a comprehensive discussion of the. Web the.

How to Calculate a Finance Lease under ASC 842

Ad uslegalforms.com has been visited by 100k+ users in the past month The new standard is effective from 1 january 2019 for public companies and 15 december 2021. Web determine if your leases are classified as finance or operating leases under asc 842. Click the link to download a template for asc 842. Web asc 842 is a lease accounting.

Sensational Asc 842 Excel Template Dashboard Download Free

Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. Ad uslegalforms.com has been visited by 100k+ users in the past month Web the rate component of the present value calculation is also called the discount rate, and your company has a few options to choose from as it applies asc 842. Web learn.

Asc 842 effective dates effective date for public companies effective date for private companies. For a comprehensive discussion of the. Web details on the example lease agreement step 1: In turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: Web the lease liability is defined as the present value of your future lease payments. Larson lease accounting template asc 842. Web lease inputs the lease agreement we’re going to calculate is based on the following details: Click the link to download a template for asc 842. Web asc 842 is a lease accounting standard by the financial accounting standards board (fasb), requiring all leases longer than 12 months to be reflected on a. Web calculate lease liability using the lease amortization schedule excel template. Determine the lease term under asc 840 step 2: Ad our software is backed by decades of lease accounting experience and trusted by experts. The new standard is effective from 1 january 2019 for public companies and 15 december 2021. Ad embarkwithus.com has been visited by 10k+ users in the past month Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. Web as noted above, the first step in calculating the lease liability, is to determine the term of the lease. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Web learn more about lease accounting. With our lease amortization schedule excel template, seamlessly.