Asc 842 Lease Accounting Template

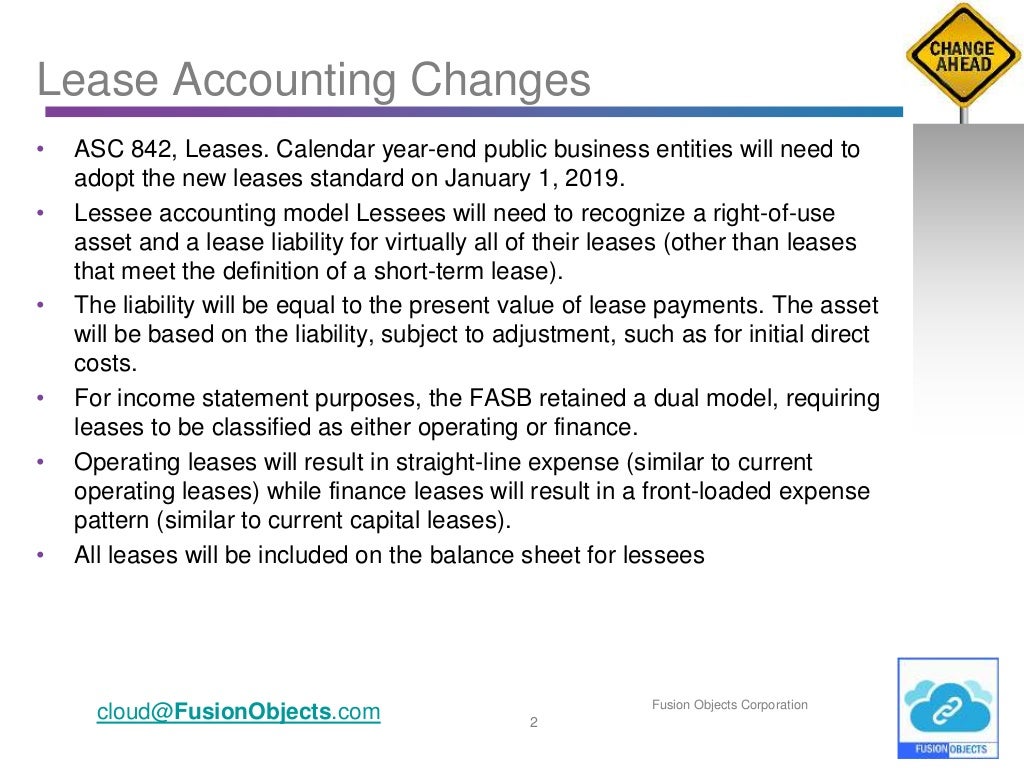

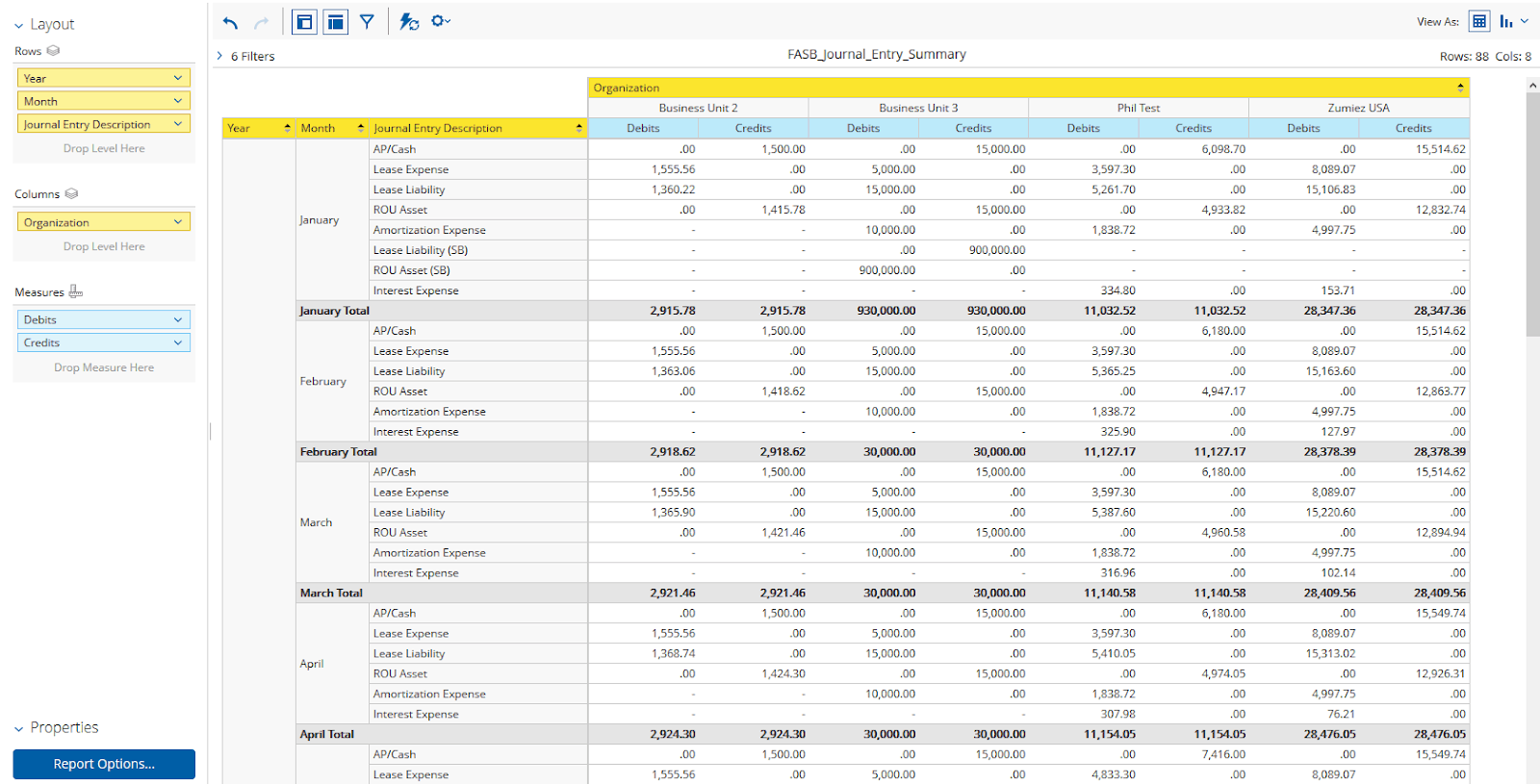

Asc 842 Lease Accounting Template - Web download now our executive summary highlights key accounting changes and organizational impacts for lessees applying asc 842. In this section, we’ll explain finance lease accounting under asc 842 using an example. Determine the lease term under asc 840 step 2: January 1, 2021 lease end date: Web pwc is pleased to offer our updated leases guide. Web asc 842 is a lease accounting standard by the financial accounting standards board (fasb), requiring all leases longer than 12 months to be reflected on a. Assume a company (lessee) signs. Determine the total lease payments under gaap step 3: Applicability lessees in the scope. Automate lease accounting and compliance to asc 842, ifrs 16 and aasb 16 with or without netsuite;

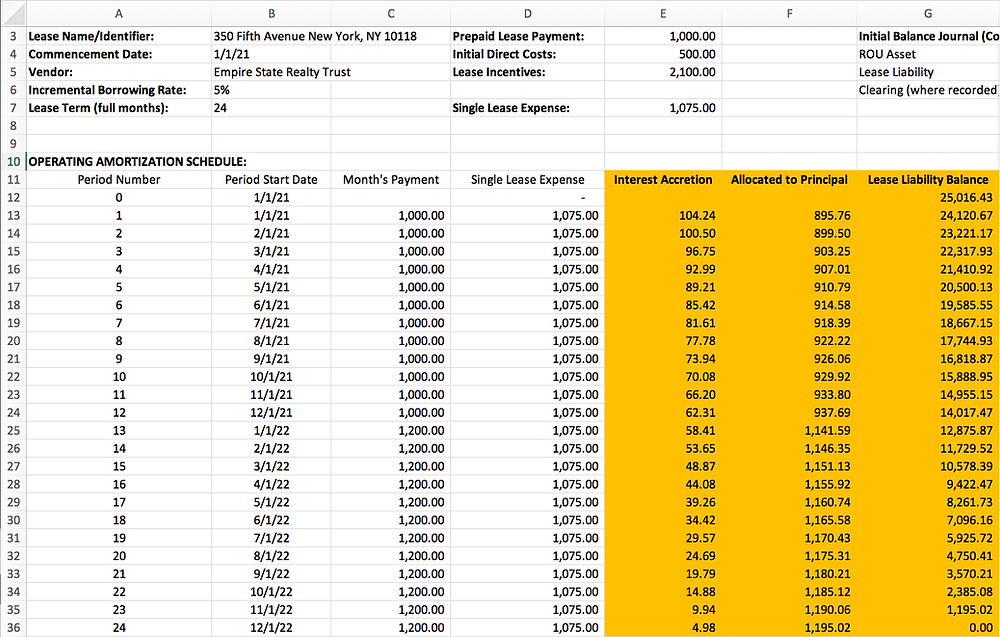

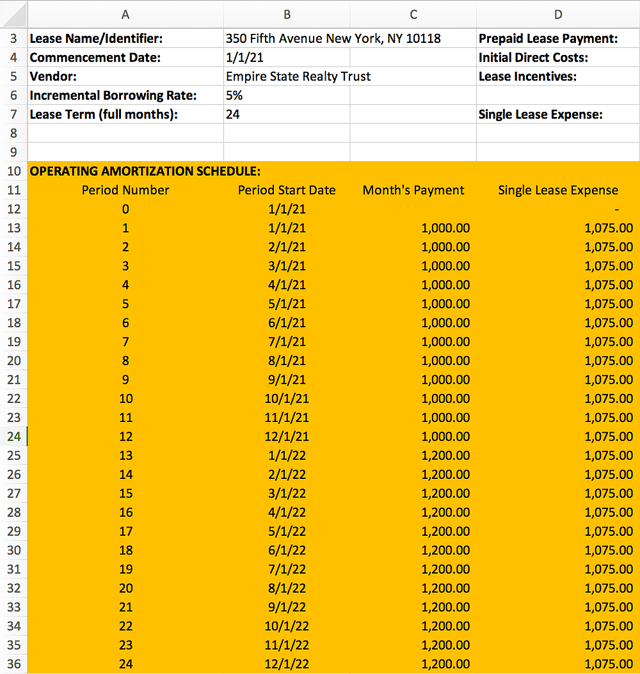

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Web 20 lease accounting 842 jobs available in remote on indeed.com. Web the asc 842 lease classification template for lessees is now available for download. Assume a company (lessee) signs. Web larson lease accounting template asc 842. Embedded lease test use this free tool to determine if your contract.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Embedded lease test use this free tool to determine if your contract. Web the asc 842 lease classification template for lessees is now available for download. Applicability lessees in the scope. Pair it with our lessee's quick guide for the ultimate in asc 842 lessee. Since the issuance of accounting standards update no.

FASB ASC 842 Lease Accounting Standard ASC 842 Compliance

Embedded lease test use this free tool to determine if your contract. Web asc 842 is a lease accounting standard by the financial accounting standards board (fasb), requiring all leases longer than 12 months to be reflected on a. Web finance lease accounting example. Web 1 summary why is the fasb issuing this accounting standards update (update)? Pair it with.

Asc 842 Lease Accounting Excel Template

Embedded lease test use this free tool to determine if your contract. Applicability lessees in the scope. Determine the total lease payments under gaap step 3: Web the asc 842 lease classification template for lessees is now available for download. This asc 842 accounting memo template for lessees should be used as a guide when your accounting team is assessing.

ASC 842 Excel Template Download

Web use this free tool to determine if your leases are classified as finance or operating leases under asc 842. Click the link to download a template for asc 842. Determine the lease term under asc 840 step 2: Web tips, insights, and a handy template from embark’s asc 842 experts to help lessees identify and properly account for those.

Sensational Asc 842 Excel Template Dashboard Download Free

Determine the lease term under asc 840 step 2: Web 14.1.1 embedded leases and scope of the leasing guidance (asc 842/ifrs 16) under both asc 842 and ifrs 16, even if not a lease in its entirety, an arrangement includes an. In this section, we’ll explain finance lease accounting under asc 842 using an example. Web asc 842 is a.

ASC 842 Guide

Web 1 summary why is the fasb issuing this accounting standards update (update)? Click the link to download a template for asc 842. This asc 842 accounting memo template for lessees should be used as a guide when your accounting team is assessing the impact of asc 842 to their business. Web lease inputs the lease agreement we’re going to.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Determine the total lease payments under gaap step 3: Determine the lease term under asc 840 step 2: Automate lease accounting in any erp for asc 842, ifrs 16 and gasb 87; Web 20 lease accounting 842 jobs available in remote on indeed.com. Web lease inputs the lease agreement we’re going to calculate is based on the following details:

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

This asc 842 accounting memo template for lessees should be used as a guide when your accounting team is assessing the impact of asc 842 to their business. Web asc 842 is a lease accounting standard by the financial accounting standards board (fasb), requiring all leases longer than 12 months to be reflected on a. Web larson lease accounting template.

Asc 842 Lease Accounting Excel Template

Automate lease accounting in any erp for asc 842, ifrs 16 and gasb 87; Web download now our executive summary highlights key accounting changes and organizational impacts for lessees applying asc 842. Automate lease accounting and compliance to asc 842, ifrs 16 and aasb 16 with or without netsuite; Web lease inputs the lease agreement we’re going to calculate is.

Pair it with our lessee's quick guide for the ultimate in asc 842 lessee. Apply to senior accountant, accounting manager, director of accounting and more! Automate lease accounting in any erp for asc 842, ifrs 16 and gasb 87; Embedded lease test use this free tool to determine if your contract. Assume a company (lessee) signs. Since the issuance of accounting standards update no. Determine the lease term under asc 840 step 2: Web what does our lease classification template cover? Automate lease accounting and compliance to asc 842, ifrs 16 and aasb 16 with or without netsuite; Web larson lease accounting template asc 842. Click the link to download a template for asc 842. Applicability lessees in the scope. Web finance lease accounting example. The fasb’s new standard on leases, asc 842, is already effective for public companies and is replacing today’s leases. Web asc 842 is a lease accounting standard by the financial accounting standards board (fasb), requiring all leases longer than 12 months to be reflected on a. Web the asc 842 lease classification template for lessees is now available for download. Web use this free tool to determine if your leases are classified as finance or operating leases under asc 842. Web 20 lease accounting 842 jobs available in remote on indeed.com. Web 1 summary why is the fasb issuing this accounting standards update (update)? Determine the total lease payments under gaap step 3: