Dave Ramsey Debt Snowball Template

Dave Ramsey Debt Snowball Template - Web this is the fun one! Jan feb mar 100% 10% Web this technique, made popular by financial guru dave ramsey, is an especially great technique to try if you are having trouble getting motivated to pay off your debt. Web dave ramsey’s debt snowball method is a way to quickly pay off your debt. Once the smallest debt is paid off, one proceeds to the next larger debt, and so forth, proceeding to the largest ones last. Pay as much as possible on your smallest debt. You may have noticed that the smallest debt is paid first, not the highest interest rate. Web if you are wanting to pay off debt on your own, this works! Debt avalanche and debt snowball. Web what is the debt snowball?

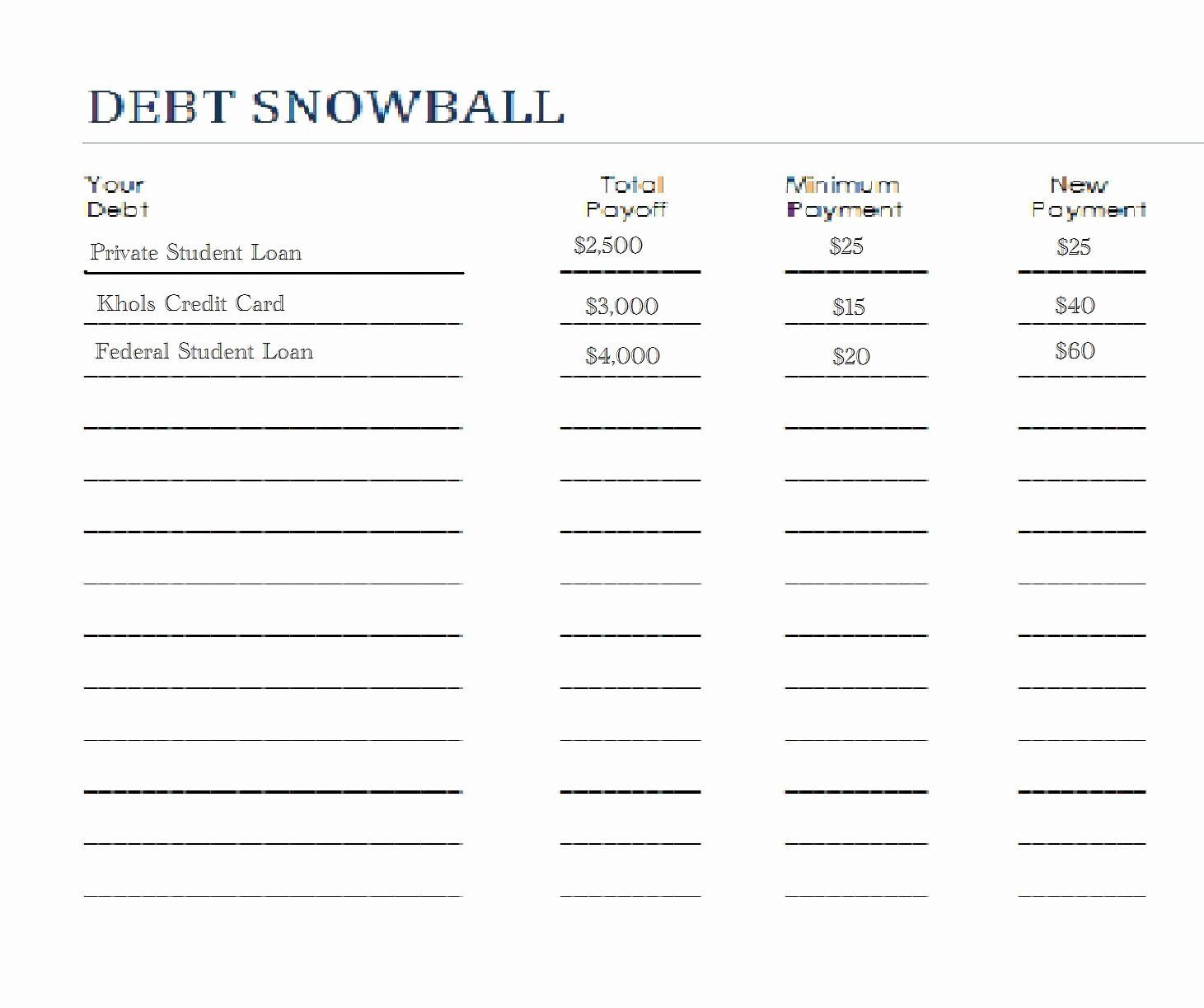

Dave Ramsey Debt Snowball Worksheets —

There are tons of ways to pay off debt, but i would argue that this method is the most successful. With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. Document your debts and include their balances. Web dave ramsey debt snowball. Here are the basic steps if the debt snowball method.

Dave Ramsey Debt Snowball Calculator Excel Budget Planner Etsy

Web dave ramsey debt snowball calculator! Use the famous dave ramsey method to payoff your debt, using this automatic tracker template! Web what is the debt snowball? Jan feb mar 100% 10% Pay off all debt (except the house) using the debt snowball.

Dave Ramsey Inspired Debt Snowball Spreadsheet Excel Etsy

Web the debt snowball method is the best way to get out of debt. Web the debt snowball is a methodology to pay off debt developed by david ramsey. Web the snowball method is a common debt repayment strategy. That’s where we first heard about it, and when we first started working to become debt free, we knew the basic.

Using Dave Ramsey's debt snowball method to pay off debt? This free

Here are the basic steps if the debt snowball method. You begin by listing your debts from smallest to largest in terms of the balance. Jan feb mar 100% 10% To get things rolling, you can easily use dave ramsey’s debt snowball form to create and track your debt payoff progress. With the debt snowball method, you pay off your.

Dave Ramsey Debt Snowball Spreadsheet Calculator Credit Card Etsy Ireland

Jan feb mar 100% 10% Web dave ramsey debt snowball calculator! It may be a good solution to better manage your finances over time. The snowball method is all about building momentum as you pay off debt. And while dave ramseypopularized the debt snowball method, he didn’t actually create it.

Dave Ramsey Debt Snowball Spreadsheet Calculator Credit Card Etsy Ireland

But before you adopt this approach,. Use this pink excel budget planner spreadsheet as a financial tool to become debt free! Document your debts and include their balances. Web the debt snowball method is the best way to get out of debt. Web r a c k e r debt name goal payoff date creditor:

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Etsy

List your debts from smallest to largest regardless of interest rate. Web r a c k e r debt name goal payoff date creditor: Web what is the debt snowball? Attack that one with everything you’ve got, using any extra money you have left after you’ve covered necessities. Get your debt snowball rolling.

Dave Ramsey Debt Snowball Spreadsheet Calculator Credit Card Etsy Ireland

With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. And while dave ramseypopularized the debt snowball method, he didn’t actually create it. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. But it doesn’t have to.

It's easy to pay off debt quickly with Dave Ramsey's debt snowball

This is the exact debt snowball form that we used to get out debt in that short period of time. List all of your debts smallest to largest, and use this sheet to mark them off one by one. Pay off all debt (except the house) using the debt snowball. Use this pink excel budget planner spreadsheet as a financial.

Dave Ramsey Debt Snowball Worksheets —

Once the smallest debt is paid off, one proceeds to the next larger debt, and so forth, proceeding to the largest ones last. Get expert advice delivered straight to your inbox. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. This method focuses on paying.

But it doesn’t have to be. There are two popular methods folks use to become debt free: Debt avalanche and debt snowball. These worksheets ensure that it’s easy to clear off your debt promptly and visibly see the progress you’re making. List your debts from smallest to largest regardless of interest rate. Web dave ramsey is famous for spreading the concept of the debt snowball spreadsheet or debt reduction spreadsheet. Web if you are wanting to pay off debt on your own, this works! Web the debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Web here’s how the debt snowball works: Web let’s discuss the different templates to use. Web this is the fun one! Use the famous dave ramsey method to payoff your debt, using this automatic tracker template! That’s where we first heard about it, and when we first started working to become debt free, we knew the basic principle is to pay off your smallest debt as fast as possible. Pay as much as possible on your smallest debt. You begin by listing your debts from smallest to largest in terms of the balance. Make minimum payments on all your debts except the smallest. Repeat until each debt is paid in full. Jan feb mar 100% 10% Web what is the debt snowball? This method focuses on paying down your smallest debt balance before moving onto larger ones.