Dcf Valuation Excel Template

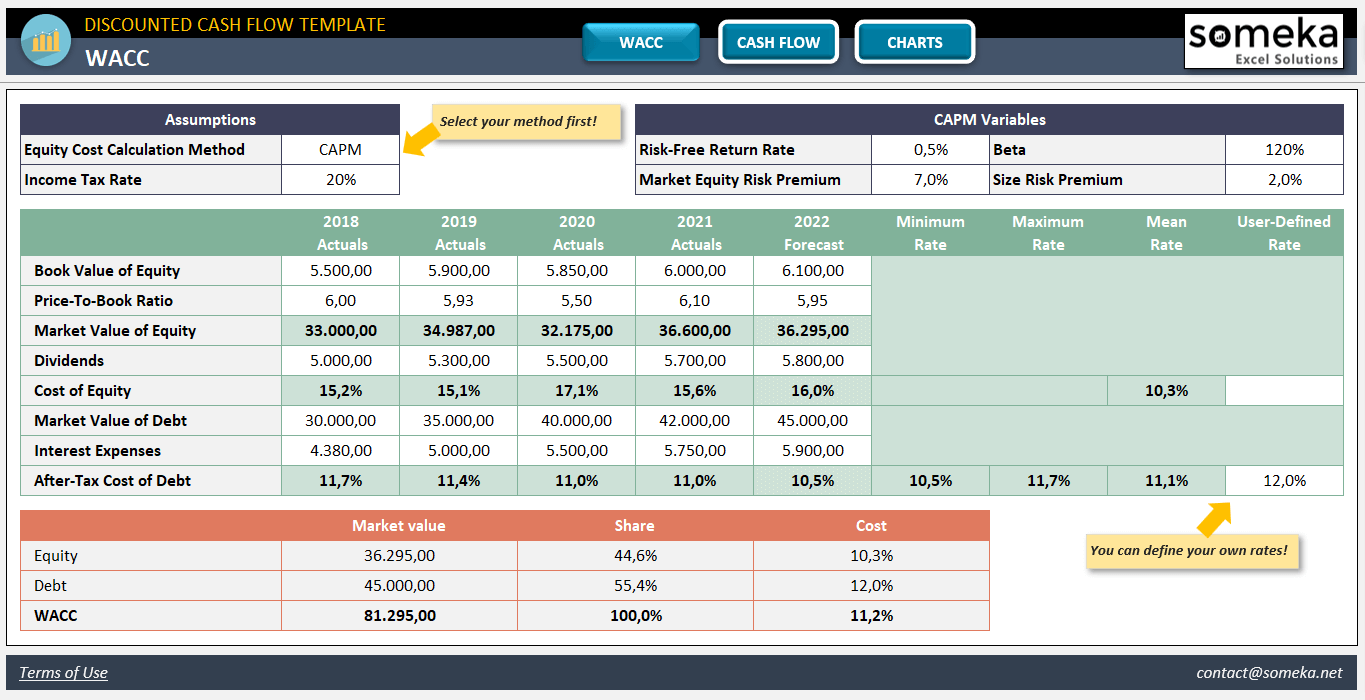

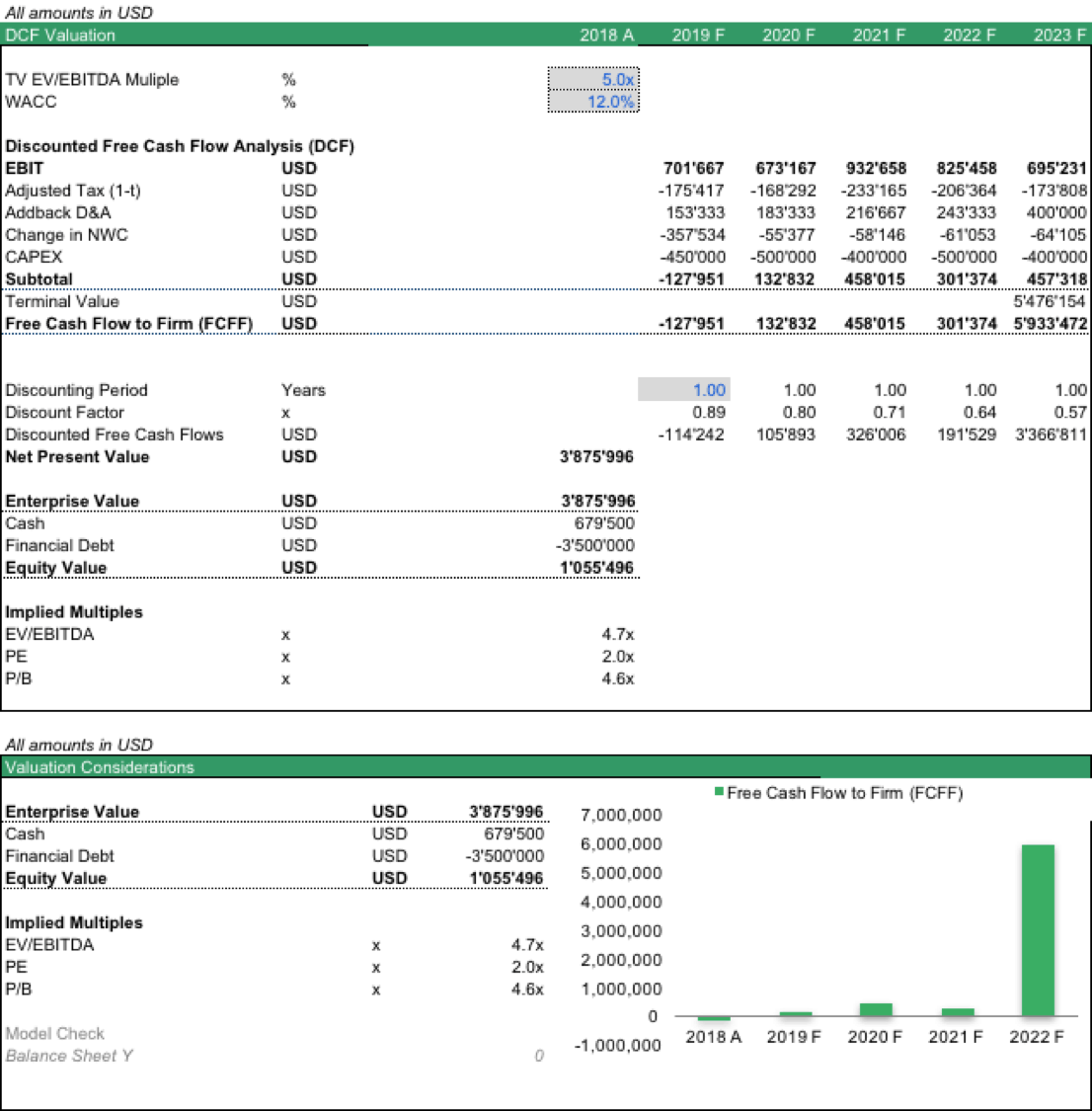

Dcf Valuation Excel Template - With the help of specialized. Download wso's free discounted cash flow (dcf) model template below! Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web click here to download the dcf template to do this, dcf finds the present value of future cash flows using a discount rate. Web what is the discounted cash flow dcf formula? Web this startup valuation method is used to understand the range of a company’s revenue potential. Therefore, the most used and theoretical sound valuation method for. It means you can do calculations of the discounted cash flow (dcf) model in the excel spreadsheet. Get powerful, streamlined insights into your company’s finances. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions.

DCF model Discounted Cash Flow Valuation eFinancialModels

Web discounted cash flow template. Below is a preview of the dcf model template: Get powerful, streamlined insights into your company’s finances. Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow. Therefore, the most used and theoretical sound valuation method for.

Valuation Model (DCF) (Excel workbook (XLS)) Flevy

Therefore, the most used and theoretical sound valuation method for. Web what is the discounted cash flow dcf formula? Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Below is a preview of the dcf model template: How to build a dcf.

Valuation Model (DCF) (Excel) Financial analysis, Workbook, Business

A dcf calculator helps in valuing a company's stock by estimating its present value based on its future cash flows. Get powerful, streamlined insights into your company’s finances. The discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate. Web this startup valuation method is used.

Free DCF Template Excel [Download & Guide] Wisesheets Blog

Once you have the pv it can then be. It means you can do calculations of the discounted cash flow (dcf) model in the excel spreadsheet. Web the dcf valuations can be easily done in excel. With the help of specialized. Budget financial model allows you to spend less time on finances and more time on your products, customers, and.

Discounted Cash Flow (DCF) Model Macabacus

Get powerful, streamlined insights into your company’s finances. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web click here to download the dcf template to do this, dcf finds the present value of future cash flows using a discount rate. This.

DCF Model Full Guide, Excel Templates, and Video Tutorial (2022)

Web discounted cash flow valuation is a form of intrinsic valuation and part of the income approach. Web click here to download the dcf template to do this, dcf finds the present value of future cash flows using a discount rate. Therefore, the most used and theoretical sound valuation method for. Enter your name and email in the form below.

Discounted Cash Flow Excel Template DCF Valuation Template

The discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate. Web click here to download the dcf template to do this, dcf finds the present value of future cash flows using a discount rate. Enter your name and email in the form below and download.

DCF model tutorial with free Excel

Once you have the pv it can then be. Below is a preview of the dcf model template: It means you can do calculations of the discounted cash flow (dcf) model in the excel spreadsheet. Web this startup valuation method is used to understand the range of a company’s revenue potential. Web discounted cash flow template.

Discounted Cash Flow Valuation in Excel Explained StepByStep Video

Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. The discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate. Once you have the pv it can then.

DCF model Discounted Cash Flow Valuation eFinancialModels

Web what is the discounted cash flow dcf formula? Web financial modeling & valuation * mcdonalds step by step modeling from scratch * valuations * certificate of completion learn more * valuations (dcf, ddm, comparable. A dcf calculator helps in valuing a company's stock by estimating its present value based on its future cash flows. Enter your name and email.

Once you have the pv it can then be. Web this startup valuation method is used to understand the range of a company’s revenue potential. Web one of the most versatile valuation methods, discounted cash flow (dcf) calculators and financial models can be used for: Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow. Web click here to download the dcf template to do this, dcf finds the present value of future cash flows using a discount rate. Budget financial model allows you to spend less time on finances and more time on your products, customers, and business development. Download wso's free discounted cash flow (dcf) model template below! How to build a dcf model: With the help of specialized. Below is a preview of the dcf model template: This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web start free written by cfi team what is valuation modeling in excel? Get powerful, streamlined insights into your company’s finances. This template allows you to build your own discounted cash flow model with. Web discounted cash flow template. It means you can do calculations of the discounted cash flow (dcf) model in the excel spreadsheet. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. The discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate. Web financial modeling & valuation * mcdonalds step by step modeling from scratch * valuations * certificate of completion learn more * valuations (dcf, ddm, comparable. Web what is the discounted cash flow dcf formula?

![Free DCF Template Excel [Download & Guide] Wisesheets Blog](https://cdn-eaclf.nitrocdn.com/osNuHhBvVdZeEkSNJhSMrIuyqQJMcjPL/assets/static/optimized/rev-09e077f/wp-content/uploads/2022/07/Screen-Shot-2022-07-03-at-11.57.05-AM-1024x539.png)