Discounted Cash Flow Model Excel Template

Discounted Cash Flow Model Excel Template - Below is a preview of the dcf model template: Web dcf model, financial analysis, financial planning. Web written by cfi team. Start your dcf analysis today! Export this template to excel with just one click. Join 307,012+ monthly readers mergers & inquisitions Discount the projection period and terminal cash flows to the present using the discount rate. This video alongside dcf model template in excel will teach you how to build a basic discounted cash flow model. The template uses both a multiples method. Discounted cash flow (dcf) calculates the value of a company based on future cash flows;

Discounted Cash Flow Valuation Excel » The Spreadsheet Page (2022)

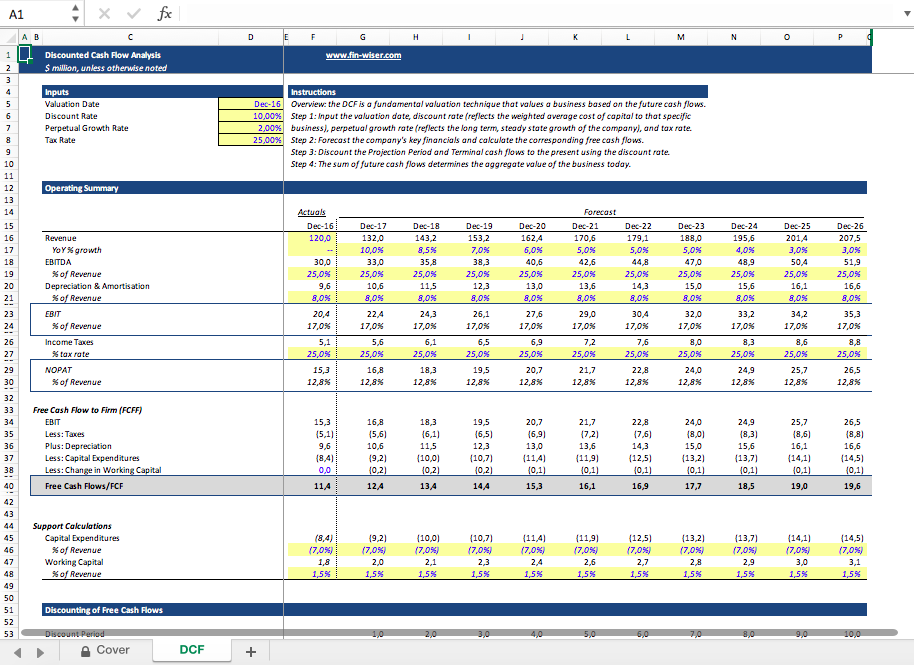

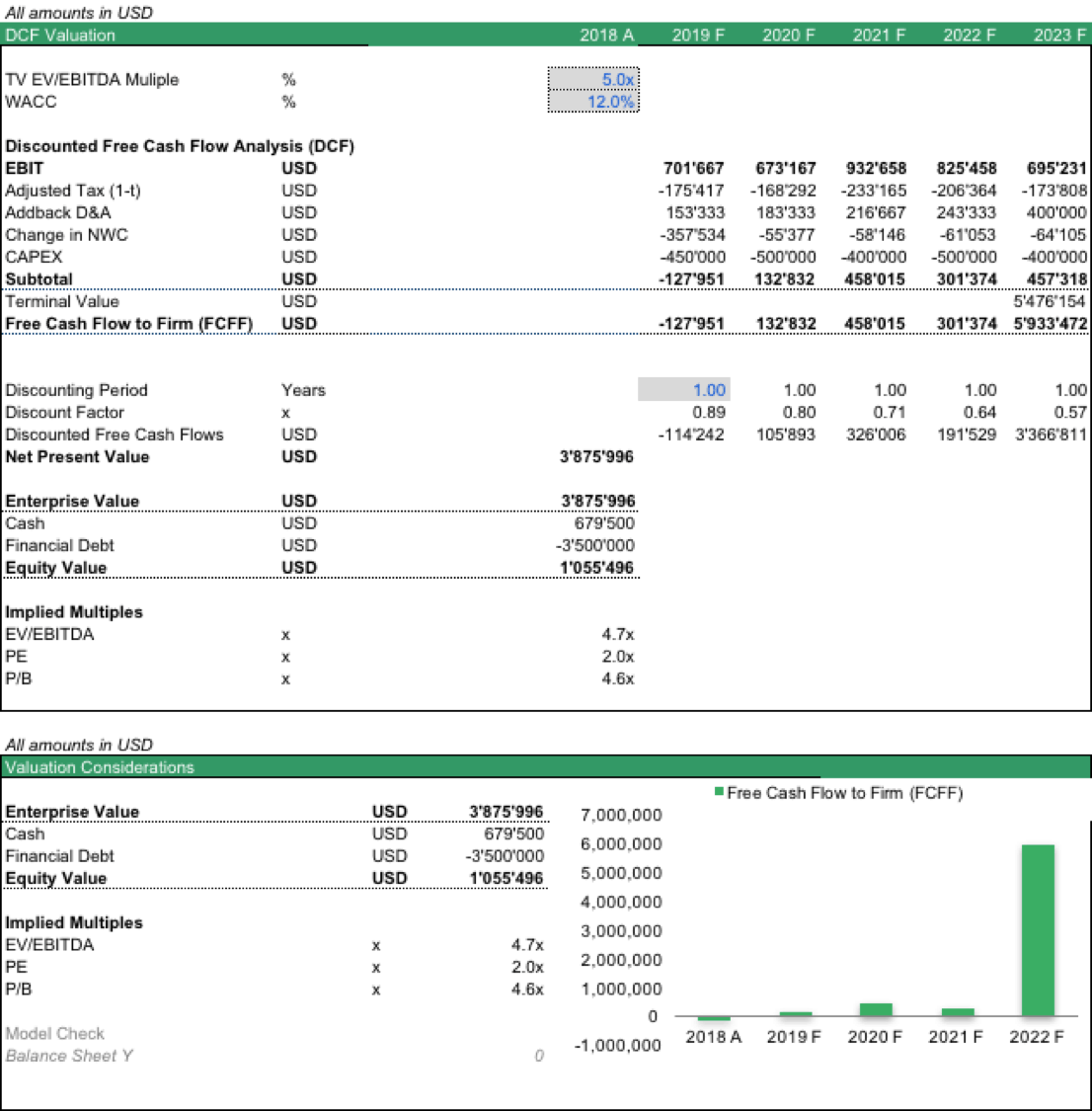

The template uses the discounted cash flow (dcf) method, which discounts future cash flows back to. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Below is a preview of the dcf model template: Dcf is basically used to calculate the present value of the cash flow of the company..

DCF Discounted Cash Flow Model Excel Template Eloquens

Export this template to excel with just one click. It is basically based on methods that will determine how much money the. Start your dcf analysis today! So what does a dcf entail and why do we use it? The executive summary also provides a quick overview of the whole dcf excel template.

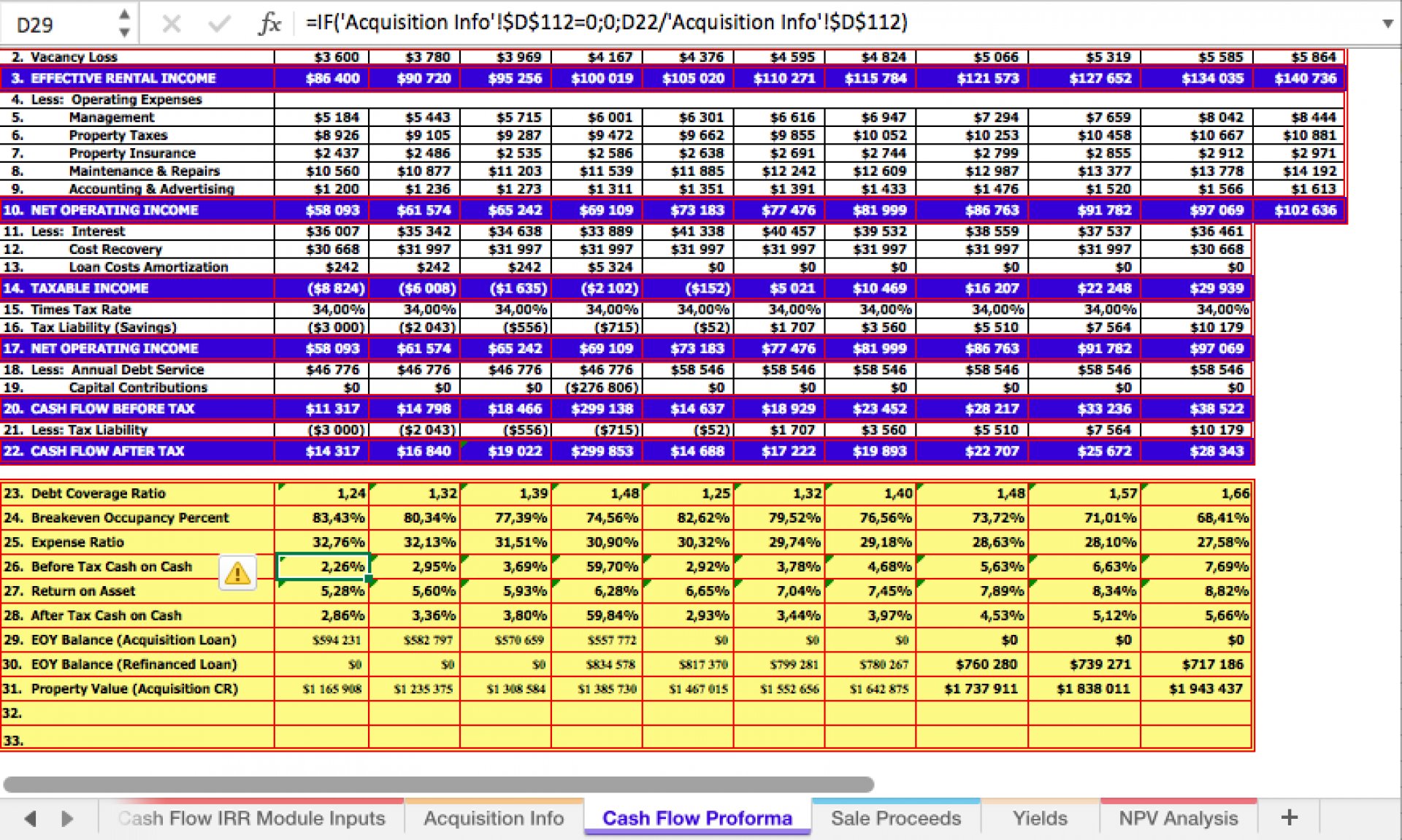

Excel Discounted Cash Flow (DCF) Analysis Model with IRR and NPV Eloquens

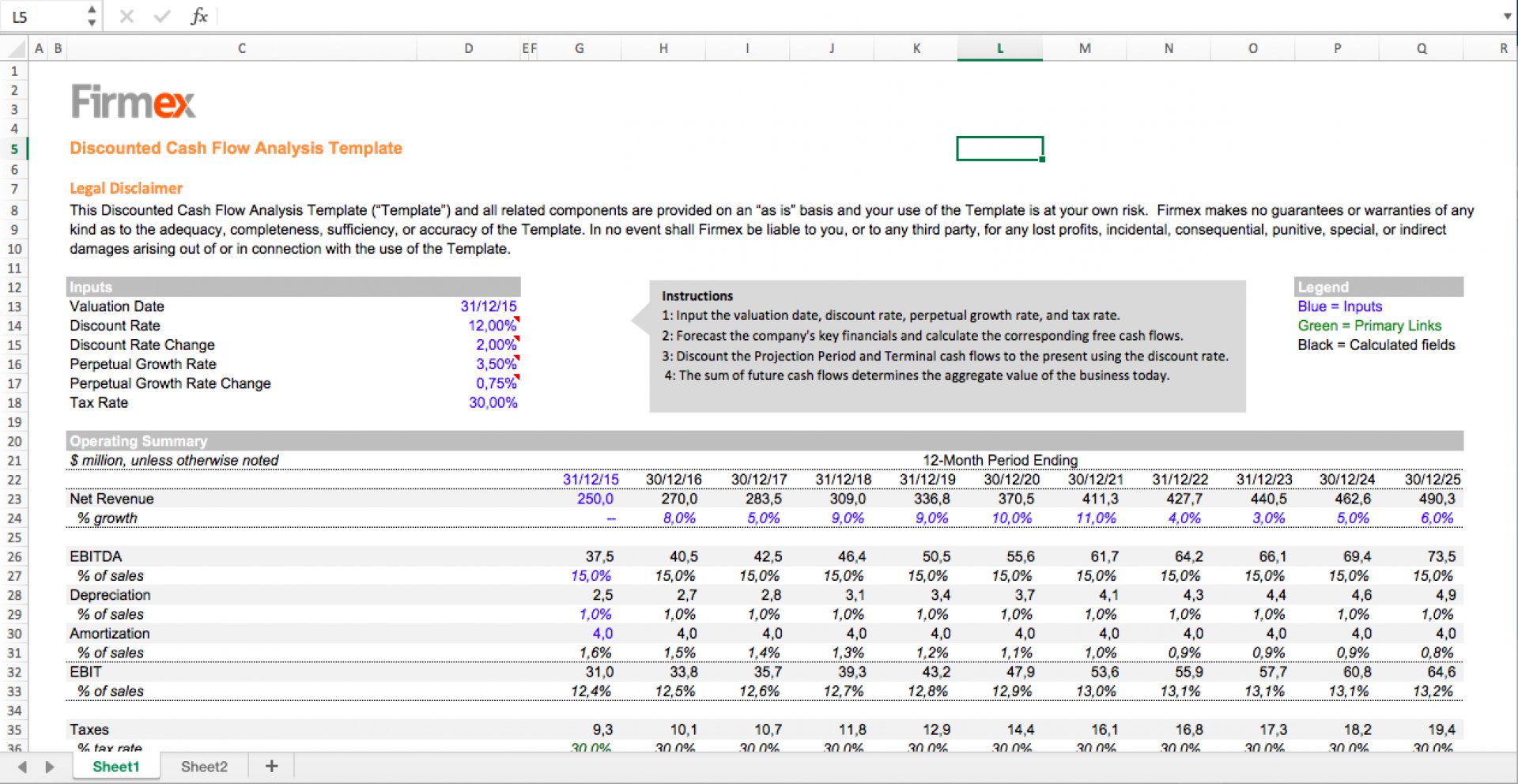

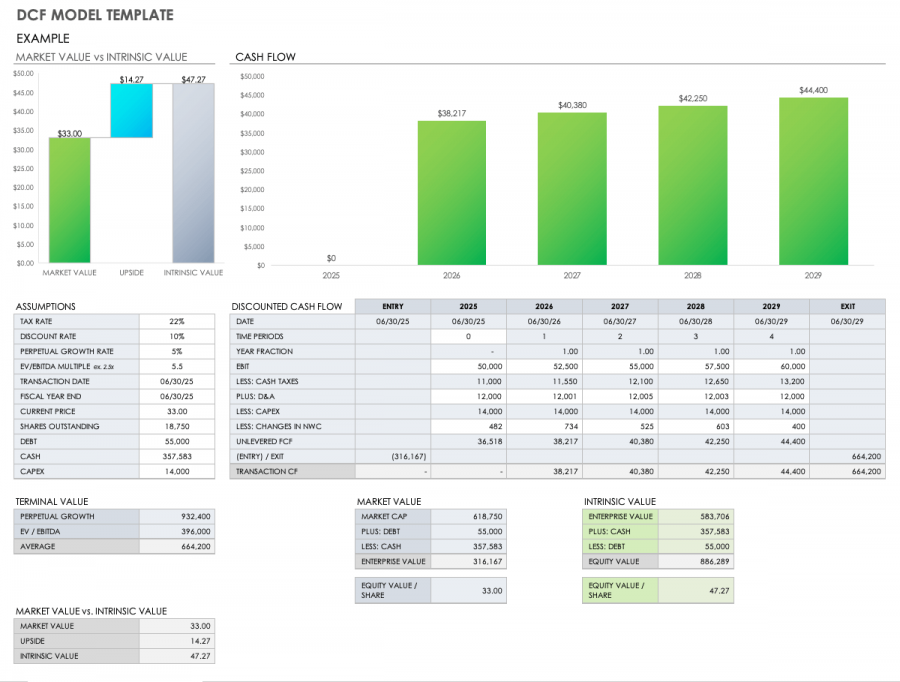

Enter your name and email in the form below and download the free template now! Web 10 discounted cash flow excel template free: Use the form below to download our sample dcf model template: Therefore, all future cash flows must be taken into consideration. Input the valuation date, discount rate, perpetual growth rate, and tax rate.

7 Cash Flow Analysis Template Excel Excel Templates

Web dcf stands for discounted cash flow. First name * email * continue reading below. A dcf model is a specific type of financial modeling tool used to value a business. 4.7 ( 10 reviews ) dcf valuation spreadsheet in excel. The macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling.

DCF Discounted Cash Flow Model Excel Template Eloquens

Experts are tested by chegg as specialists in their subject area. What is a dcf model? This ufcf calculation template provides you with insight into the tangible and intangible assets generated by your business that are available for distribution to all capital providers. The macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. Web.

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

The template uses both a multiples method. The executive summary also provides a quick overview of the whole dcf excel template. =npv(discount rate, series of cash flows) If you're looking for discounted cash flow excel templates, look no further! Discount the projection period and terminal cash flows to the present using the discount rate.

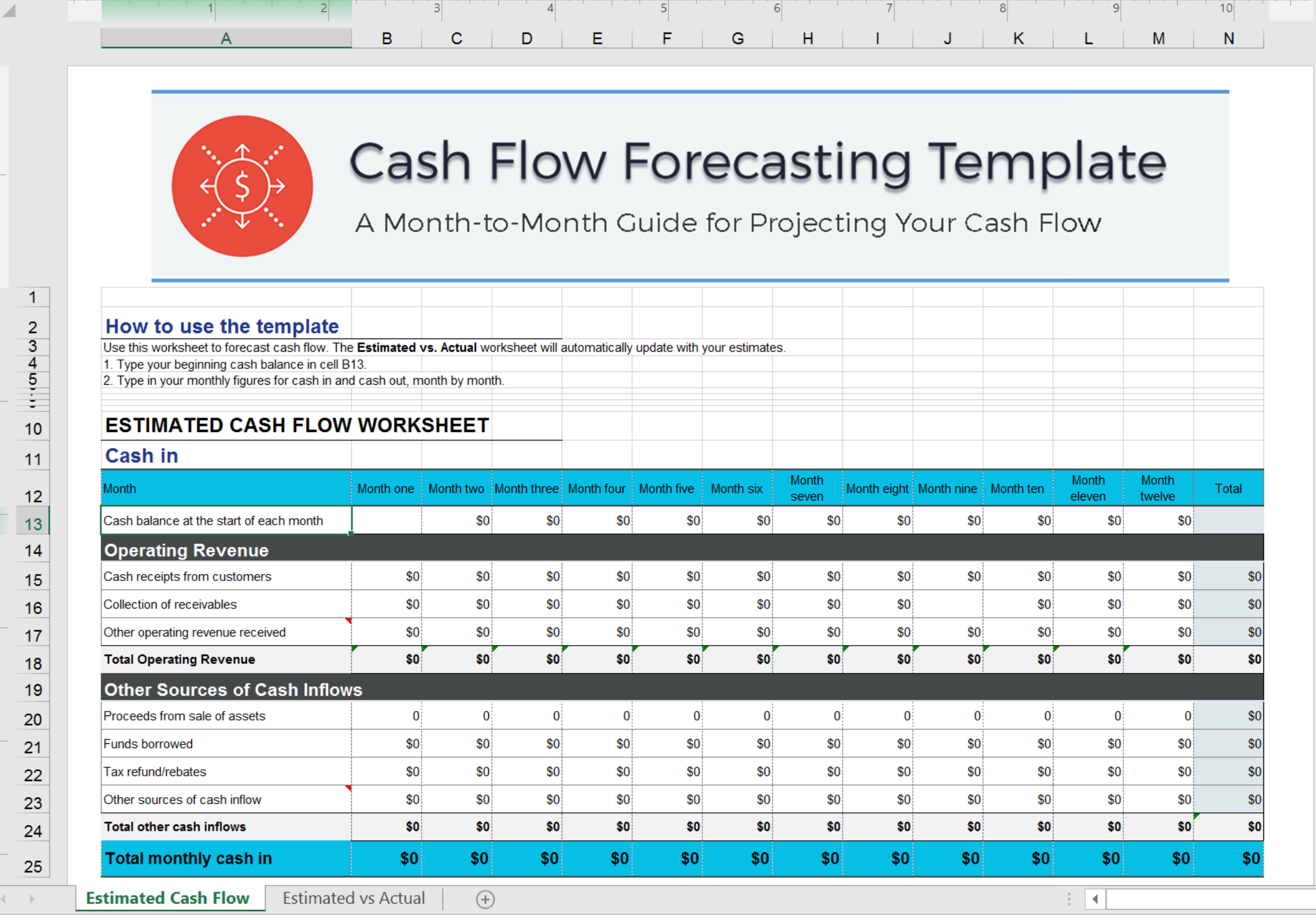

Cash Flow Excel Template Forecast Your Cash Flow

Download wso's free discounted cash flow (dcf) model template below! Web written by cfi team. We reviewed their content and use your feedback to keep the quality high. If you're looking for discounted cash flow excel templates, look no further! The template uses the discounted cash flow (dcf) method, which discounts future cash flows back to.

DCF model Discounted Cash Flow Valuation eFinancialModels

You can also copy the formulas down for more years. Experts are tested by chegg as specialists in their subject area. Learn more → investment banking primer. Download wso's free discounted cash flow (dcf) model template below! The macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling.

Discounted Cash Flow Model Template in Excel By exDeloitte Consult…

A basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Learn more → investment banking primer. Web ms excel has two formulas that can be used to calculate discounted cash flow, which it terms as “npv.” regular npv formula: It can guess the.

Free Discounted Cash Flow Templates Smartsheet

=npv(discount rate, series of cash flows) Join 307,012+ monthly readers mergers & inquisitions Estimate value of future cash flows. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered.

Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. This file allows you to calculate discounted cash flow in excel. The discount factor increases over time (meaning the decimal value gets smaller) as the effect of compounding the discount. Dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called the net present value (npv). You can also copy the formulas down for more years. Web please provide a completed dcf (discounted cash flow) model on excel for the company google (googl) expert answer. Dcf = cf1 / 1 + r1 + cf2 / 1 + r2 + cfn / 1 + rn. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Use the form below to download our sample dcf model template: This template allows you to build your own discounted cash flow model with different assumptions. Web download the free template. So what does a dcf entail and why do we use it? Web the terms discounted cash flow analysis, discounted cash flow model, discounted cash flow technique,. Start your dcf analysis today! Therefore, all future cash flows must be taken into consideration. A basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Dcf is basically used to calculate the present value of the cash flow of the company. Rated 4.70 out of 5 based on 10 customer ratings. First name * email * continue reading below. Web 10 discounted cash flow excel template free: