Irs B Notice Template

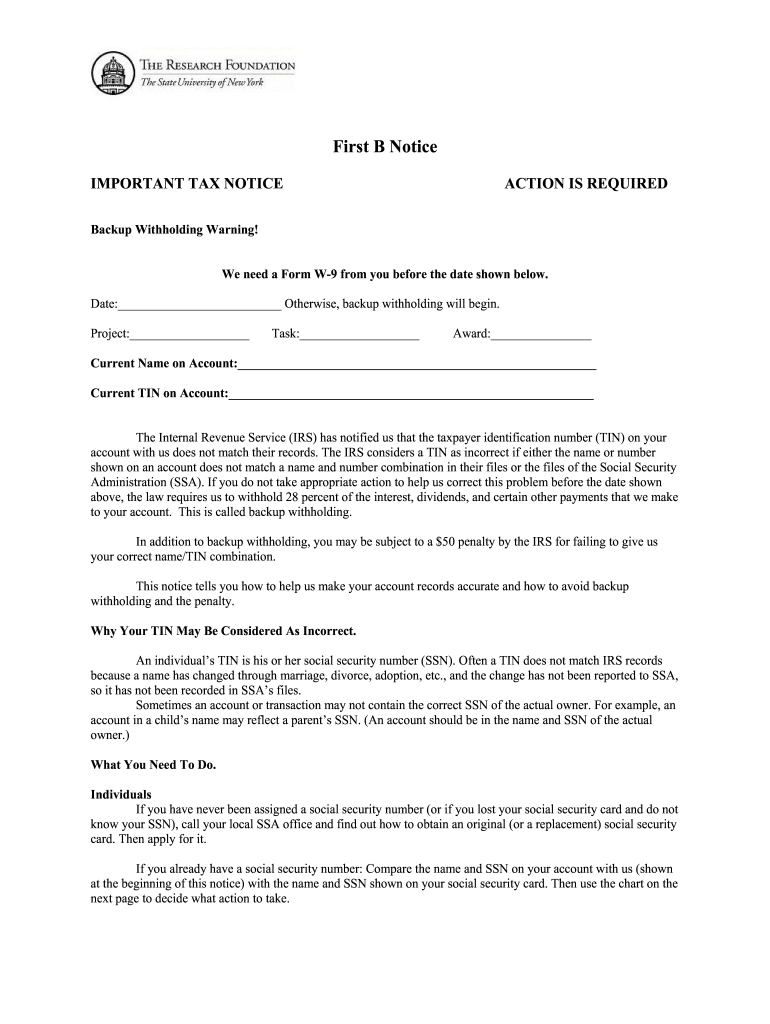

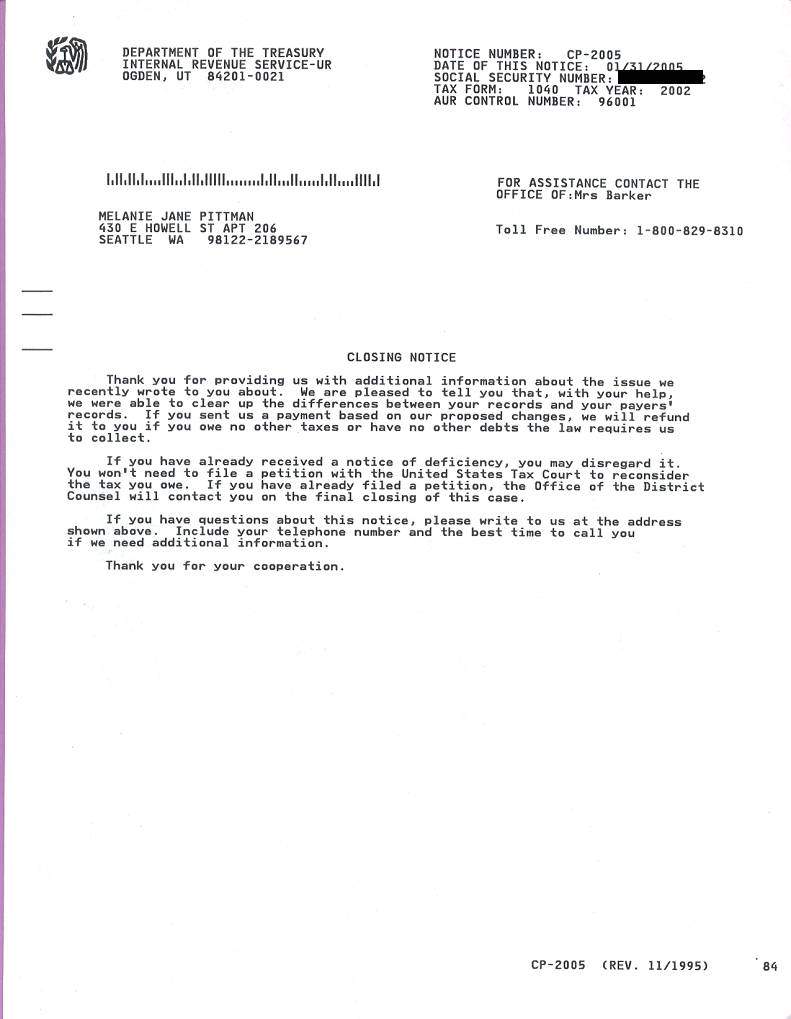

Irs B Notice Template - Web a “b” notice is a backup withholding notice. Web lt11f sample notice : Web when the irs needs to ask a question about a taxpayer's tax return, notify them about a change to their account, or request a payment, the agency often mails a. There are situations when the payer is required to withhold at the current rate of 24 percent. Web these notices are commonly referred to as “b” notices and are generally issued to payers who in the prior year filed form(s) 1099 information returns, with the. Web what you need to do. Web templates should be created with approved messaging to send to b notice recipients that will request the proper information. If you have any questions about backup withholding, information reporting, forms 1099, or the cp2100 or cp2100a notices and listing(s), you may call the. You must send the first “b” notice and. Identify which irs notice you received the irs will send you a cp2100 notice or a cp2100a notice if your tax documents contain missing tins or incorrect name/tin.

B Notice Form Fill Out and Sign Printable PDF Template signNow

Web the b notice will: You must have the irs or ssa validate your. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Backup withholding, the cp2100 notice and “b” notices.

Irs Audit Notice Free Printable Documents

Web first b notice important tax notice action is required backup withholding warning! Web lt11f sample notice : Web what you need to do. To accomplish this, payers are. Web in this video, we’ll cover:

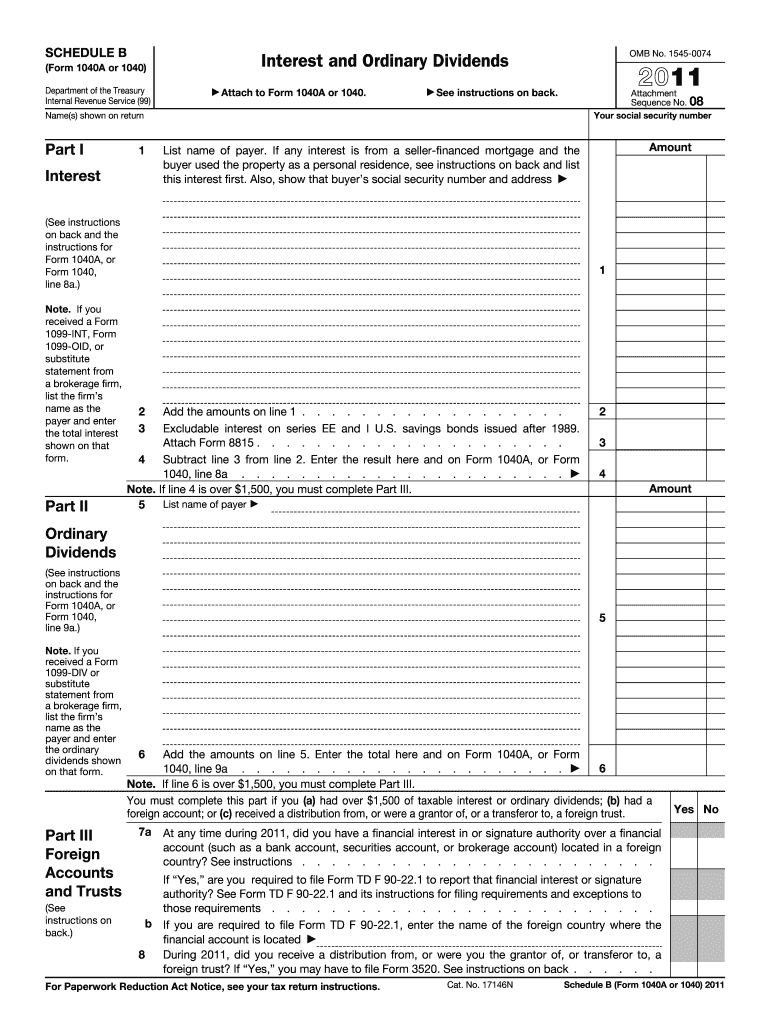

Irs Schedule B Form Fill Out and Sign Printable PDF Template signNow

Web send filled & signed form or save irs b notice word template rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.49 satisfied 37 votes how to fill out and sign first b notice template. Web when the irs needs to ask a question about a taxpayer's tax return, notify them about.

Notice Of Repossession Letter Template

Identify which irs notice you received the irs will send you a cp2100 notice or a cp2100a notice if your tax documents contain missing tins or incorrect name/tin. The irs provides a template letter in. Web refer to publication 1281 [pdf 924 kb] for additional information and a sample template of each of the b notices. You must send the.

IRS Audit Letter 2202B Sample 1

The irs provides a template letter in. Web lt11f sample notice : If you have never been assigned a social security number (or if you lost your social security card and do not know your ssn), call your local ssa office and. Web what is backup withholding? Web check that your mailing address is correct and up to date with.

IRS Audit Letter 2202B Sample 1

Web what is backup withholding? There are situations when the payer is required to withhold at the current rate of 24 percent. The irs provides a template letter in. Web what you need to do. Web refer to publication 1281 [pdf 924 kb] for additional information and a sample template of each of the b notices.

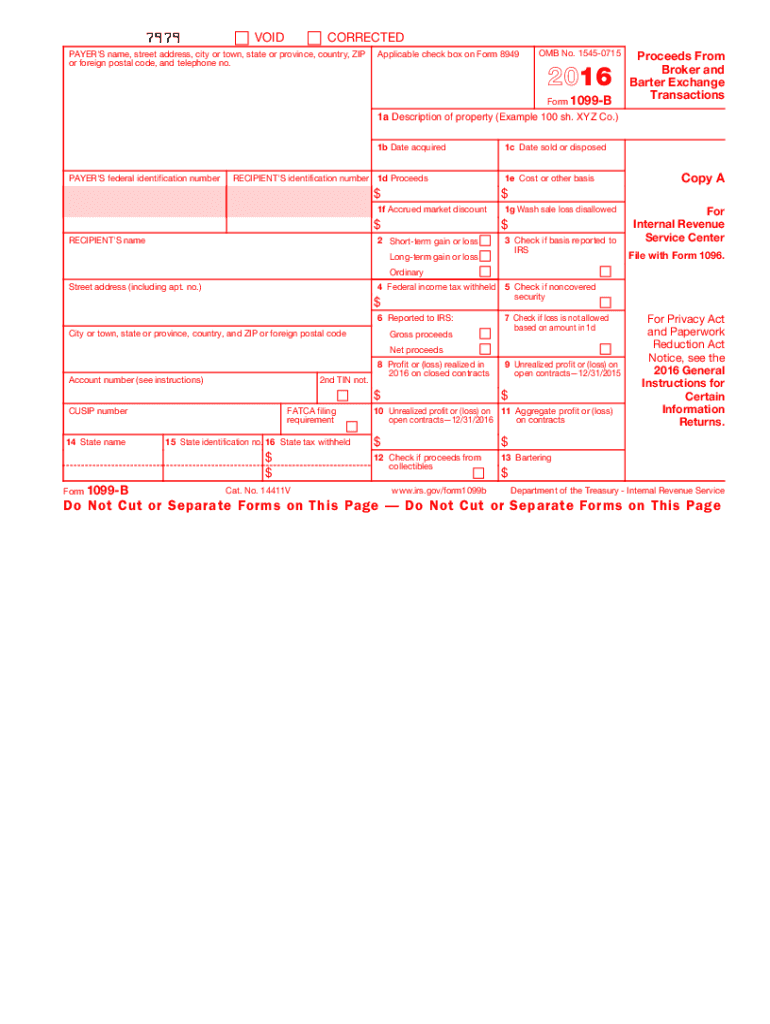

IRS 1099B 2016 Fill out Tax Template Online US Legal Forms

We hold payers responsible for knowing who they are paying. Web a “b” notice is a backup withholding notice. To accomplish this, payers are. Web send filled & signed form or save irs b notice word template rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.49 satisfied 37 votes how to fill.

B Notice Irs Fill Online, Printable, Fillable, Blank pdfFiller

Web check that your mailing address is correct and up to date with us, so you’ll receive your cp2100 or cp 2100a notice. Don't face the irs alone. Web send filled & signed form or save irs b notice word template rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.49 satisfied 37.

Explore Our Example of First B Notice Form Template in 2020 Letter

If you have never been assigned a social security number (or if you lost your social security card and do not know your ssn), call your local ssa office and. Web these notices are commonly referred to as “b” notices and are generally issued to payers who in the prior year filed form(s) 1099 information returns, with the. Web in.

Irs Audit Notice Free Printable Documents

You must send the first “b” notice and. Web when the irs needs to ask a question about a taxpayer's tax return, notify them about a change to their account, or request a payment, the agency often mails a. Web lt11f sample notice : Ad do you owe the irs? If you owe taxes, get a free consultation for irs.

Web these notices are commonly referred to as “b” notices and are generally issued to payers who in the prior year filed form(s) 1099 information returns, with the. Include date, taxpayer name, tin, backup. Don't face the irs alone. Web what is backup withholding? Compare the name and ssn on your account with us (shown at the beginning of this notice) with the name and ssn. To accomplish this, payers are. Web what you need to do. Identify which irs notice you received the irs will send you a cp2100 notice or a cp2100a notice if your tax documents contain missing tins or incorrect name/tin. Web check that your mailing address is correct and up to date with us, so you’ll receive your cp2100 or cp 2100a notice. Easily fill out pdf blank, edit, and sign them. Web when the irs needs to ask a question about a taxpayer's tax return, notify them about a change to their account, or request a payment, the agency often mails a. You must send the first “b” notice and. We mail these notices to your address of. Web templates should be created with approved messaging to send to b notice recipients that will request the proper information. Request a response date within 30 business days from the date the agency/department received the irs notice. This 24 percent tax is taken from any future. Web in this video, we’ll cover: Web the b notice will: Get free, competing quotes from leading irs tax relief experts. Web if you already have a social security number: